Have you ever wondered how to get the most out of your handyman invoice? When invoicing tradesmen’s services, it is crucial to show the mandatory details correctly in order to clearly separate the costs for working time and material costs. This is the only way your customers can deduct the wage costs and labor costs and claim them for tax purposes. This blog shows you which points you need to consider when invoicing in order to provide your customers with transparent information and, if necessary, start long-term business relationships in the best possible way.

1. The importance of a transparent craftsman invoice

As a tradesman, you know how important it is to issue a clear and comprehensible invoice. A transparent craftsman invoice creates trust and prevents misunderstandings with your customers. In particular, the separate disclosure of wage and material costs plays a key role here. This blog post gives you a comprehensive overview of the obligations and benefits associated with the detailed breakdown of wage and material costs and how you can implement these in your daily work in the best possible way.

2. Labor costs: What is included and how are they determined?

Entrepreneurs and other providers of household-related services can show labor costs and material costs separately on the invoice. But what exactly is the reason for this? Invoice recipients can deduct these expenses from tax in accordance with the “craftsmen’s bonus” under Section 35 a II EStG. However, only labor costs are affected here, not material costs.

Wage costs include all expenses that are directly related to your employees’ work performance. In addition to pure wage and salary payments, this also includes social security contributions and any bonuses for overtime or shift work. Wage costs are usually calculated on the basis of the hourly wage multiplied by the working hours spent on the respective project. Precise documentation of the working hours is essential in order to present the costs in a comprehensible manner.

3. Material costs: types and pricing at a glance

Material costs refer to all materials and products required for the execution of an order. These costs are made up of the purchase price of the materials and any surcharges for storage, transportation or procurement. It is important to itemize the material costs in the invoice in order to give the customer a clear overview of the expenses incurred. Different types of materials, such as consumables and durable goods, should also be listed separately.

4. Craftsman invoice: Legal basis for the disclosure of costs

The legal basis for creating a craftsman’s invoice is set out in the German Civil Code (BGB) and the German VAT Implementation Ordinance (UStDV). A proper invoice must show the labor and material costs separately so that the customer can claim certain costs for tax purposes, for example in the context of craftsman services in the household. It is your duty as a tradesperson to comply with these regulations precisely in order to avoid legal consequences and offer your customers every advantage.

The tax office has very precise requirements so that tradesmen’s invoices can be claimed for tax purposes. If, for example, a craftsman’s invoice does not contain a breakdown of the work performed, it will generally not be recognized. In other words: If a customer presents the tax office with a flat-rate invoice that does not show the work invoiced, there will be no tax credit. But what should a craftsman’s invoice look like?

Sample of a craftsman invoice without disclosure

of the share of labor costs

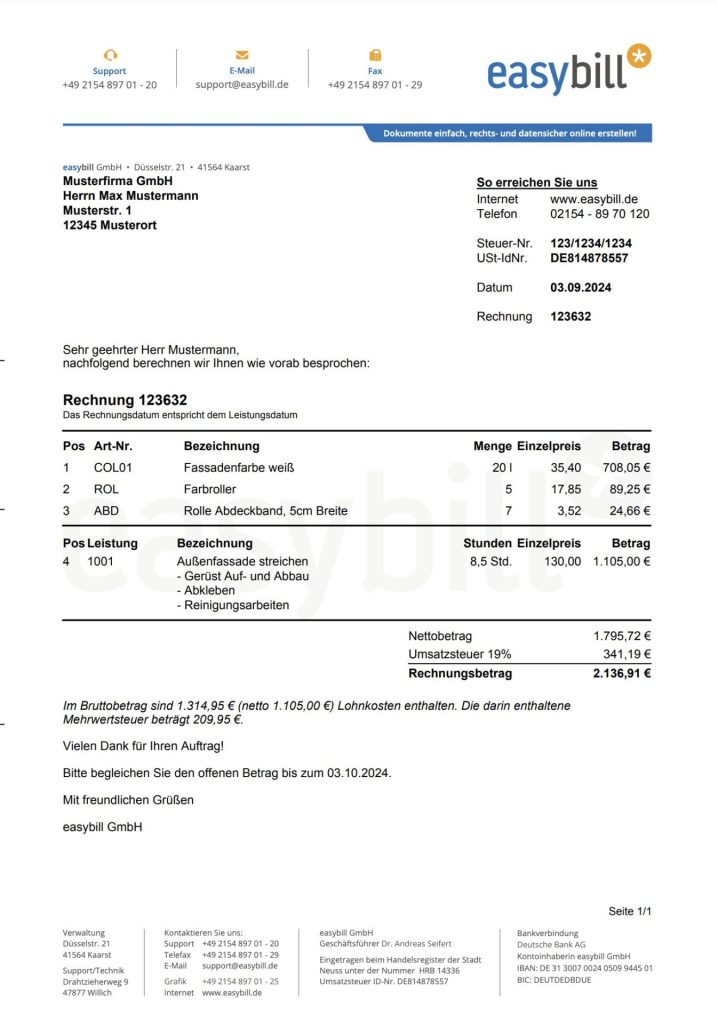

Sample of a craftsman’s invoice showing the labor cost share (§35 a II EStG)

The non-deductible material or items are clearly shown here. The working time for each activity is shown separately. This means that the tax office can immediately see the deductible portion of the invoice. An additional note below the invoice amount lists the exact proportion of labor costs.

5. The advantages of a detailed craftsman invoice for clients

A detailed craftsman invoice, in which wage and material costs are shown separately, offers your clients numerous advantages. It enables the customer to better understand the cost structure and address any ambiguities directly. In addition, the customer can deduct certain costs for tax purposes, which increases the attractiveness of your services. A transparent invoicing process thus strengthens the trust between you and your customers and can lead to long-term cooperation.

6. Tips for the correct creation of a craftsman invoice

To create a legally compliant and transparent craftsman invoice, you should follow these tips:

- Use professional software solutions to simplify the invoicing process and avoid errors.

- Ensure a clear separation of labor and material costs.

- Specify the working hours and materials used in detail.

- Check the legal requirements, such as the mandatory information on the invoice (e.g. name and address of you and the customer, tax number, invoice number).

easybill combines all these components in invoice creation. Create your own templates for invoices or partial invoices so that you can access them at any time.

7. Common errors in the reporting of labor and material costs

Despite the best intentions, errors can occur when creating tradesman invoices. Common errors include unclear separation of labor and material costs, incorrect or incomplete information on materials used or labor time, and failure to comply with legal requirements. These errors can lead to misunderstandings with the customer or even legal problems. It is therefore essential to take the time to prepare an accurate invoice and, if in doubt, to seek professional help.

A tax credit for the customer may be refused. If the invoice does not show the amount of the tax-privileged craftsman service and the non-deductible material costs, the tax office may reject this craftsman invoice under certain circumstances. The result is that the customer requests a new detailed invoice or an invoice correction in order to be able to assert their claim. This, in turn, is associated with an increased workload for the accounting department.

8. Craftsman invoicing in the digital age: software solutions and tools

In the digital age, there are numerous software solutions available to you that make the creation of tradesman invoices much easier. These tools often offer templates that ensure all legal requirements are met and allow you to easily separate labor and material costs. In addition, you can also use these solutions to make payment transactions more efficient and transmit invoices to your customers digitally, which speeds up and modernizes the entire process.

9. Transparency in the craftsman’s invoice as the key to trust

A transparent and detailed craftsman invoice is more than just a mandatory document – it is an important tool for gaining the trust of your customers and securing it in the long term. By showing labor and material costs separately, you create clarity and enable your customers to better understand the costs and take advantage of possible tax benefits. Use modern tools and always adhere to the legal requirements in order to present your trade services in a professional and trustworthy manner.

Read also:

Report labor and material costs separately (German Help Center)

Top 10 tax tips for small businesses: How to save effectively on tax

6 common mistakes when creating e-invoices