You unfortunately missed our webinar on 16.05.2023 on the topic of “Dropshipping – Opportunities and Risks”? We would be happy to summarize the most important details for you once again. In addition, you can watch the entire webinar again via easybill TV.

As a tax expert, Dennis Schümann, from DHW Steuerberatung, answered all questions during the webinar. Webinar participants were also able to contribute their personal questions on the topic and receive a live answer.

Inhaltsverzeichnis

Dropshipping explained in general

easybill: A brief explanation of dropshipping. Instead of using the direct sales channel, the retailer orders the goods from the supplier and the supplier sends the goods directly to the end consumer instead of to the retailer.

This is an exciting topic for newcomers, as there is no need to maintain a warehouse. You don’t have to buy inventory and can place orders “on the fly” with the manufacturer and ask them to ship the goods. Amazon FBA, in comparison, is not dropshipping. This is because here the goods are already in the possession of the retailer and are only deposited in Amazon’s warehouses. So here Amazon only serves as a logistics provider to ship the goods to the end customer.

Sounds very easy and understandable at first, but nevertheless many things have to be considered. Like, for example, the moving and non-moving delivery. What exactly does that mean?

Dennis Schümann: Dropshipping itself is first and foremost a classic series business, usually consisting of two suppliers and one end customer. One supplier is usually the online retailer, the other supplier is the manufacturer of the goods. The manufacturer, as the party responsible for transporting the goods, makes the moving delivery and can thus generate a tax-free export delivery. The trader, on the other hand, makes the non-moving delivery. This follows the place where the movement of goods ends and that is where the customer is located. Accordingly, it is not a distance sale from a tax perspective. Therefore, the country of destination principle applies for VAT purposes. The tax consequences of this are not always considered beforehand.

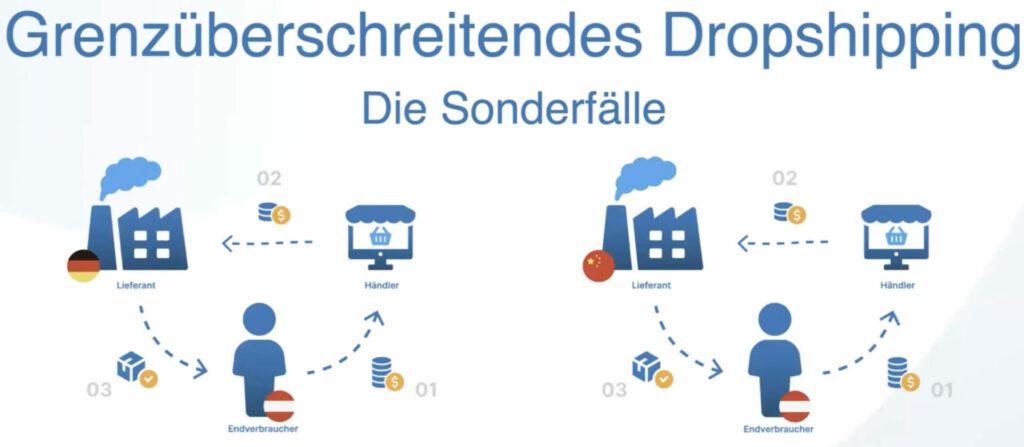

Cross-border dropshipping – The special cases

easybill: Let’s take a look at the special tax cases of dropshipping, namely cross-border deliveries. We are primarily concerned with the online retailer. The consequences here can be extremely serious, is that right?

Dennis Schümann: If all parties involved were located in Germany, for example, we wouldn’t have to discuss tax at all. We would have an invoice between the supplier and the dealer with German sales tax, on which I as a dealer could claim input tax deduction as usual. And the invoice from the retailer to the end customer would also be issued with German VAT. If the end customer is located in another EU country and I, as a retailer, am responsible for shipping from Germany, i.e. I pay my supplier, who is also located in Germany, for shipping, I can also report this via the OSS procedure.

Special case of e-commerce: dropshipping from China

easybill: But it becomes even more special when it comes to the now very common case that the supplier sends the goods to the end consumer from a third country such as China. Many traders may even mistakenly assume that the tax can be reported quite easily via the OSS or IOSS procedure. But this is not the case, correct?

Dennis Schümann: No, that is actually not possible. As already pointed out, this is not a distance sale from a tax perspective. The relevant §3c therefore does not apply. This means – and unfortunately many traders are not aware of this – that an entrepreneur must register locally for tax purposes in each EU state to which he has goods delivered by a dropshipper from China and must then also submit individual tax returns in each of these states.

easybill: So it would make more sense to limit shipping to certain target countries? So that it pays off for your own company in terms of tax?

Dennis Schümann: Yes, definitely. It should make economic sense. Countries where you hardly generate any sales should be excluded. If you want to operate dropshipping correctly in terms of sales tax, it involves a corresponding amount of effort. You should be aware of this and ideally call in professionals who deal with these complex cases on a daily basis.

Conclusion on dropshipping in e-commerce

When dropshipping within the EU, taxable sales can be reported via the OSS. However, if your dropshipper is located in a third country, you should be aware of the tax risks and not take the issue lightly.

Consult your tax advisor or contact tax experts in the field of e-commerce.

Read also:

Better Payment for a higher liquidity of your company

Invoices, taxes and co.: How to create private invoices correctly