How does the GiroCode help you here? A company’s liquidity is the top priority for most. So why not offer your customers a way to transfer and settle issued invoices even faster? Switzerland has already led the way and introduced the QR invoice as a mandatory requirement. Although there is no obligation in Germany, we also recommend including such a QR code in your most important documents.

Table of contents

What is GiroCode?

Officially, the GiroCode is actually called EPC-QR-Code (abbreviation for European Payments Council). It is a QR code that must include all the content required for a SEPA credit transfer in a standardized way. This QR code can be scanned, for example, on a smartphone or tablet using your banking app. The contents for the transfer are automatically recognized and transferred to the mobile transfer form. So most banks thus all use the uniform standard so that there are no deviations or technical challenges. The previous payment code supported by easybill, for example, was for a long time only available to customers of Sparkassen and Sparda banks. GiroCode, however, covers all major banks in Germany.

The structure of GiroCode

We don’t want to keep it too technical. But to give you a brief overview, let’s list the contents that the EPC QR code must definitely contain. The code comprises a total of 12 lines, which contain the following:

- Line 1: Service Tag (“BCD”)

- Line 2: Version (001 or 002)

- Line 3: digit for used character encoding (1= UTF-8, 2 = ISO 8859-1, 3 = ISO 8859-2, 4 = ISO 8859-4, 5 = ISO 8859-5, 6 = ISO 8859-7, 7 = ISO 8859-10, 8 = ISO 8859-15)

- Line 4: Identification as three-digit code SCT (SEPA Credit Transfer)

- Line 5: BIC of the recipient bank (mandatory if version 001 is used in line 2. For version 002, in the European Economic Area, the specification is optional)

- Line 6: Name of the payment recipient (max. 70 characters)

- Line 7: IBAN of the payment recipient

- Line 8: Payment amount (format: EURX.XX, whereby the specification is of course only optional and can also be entered by the payer)

- Line 9: Purpose (max. four-digit code according to DTA procedure, is also a purely optional specification)

- Line 10: Reference (35-character code according to ISO 11649 RF Creditor Reference, also a purely optional specification)

- Line 11: Reason for transfer (optional information with max. 140 characters)

- Line 12: additional (optional) note to the user of max. 70 characters

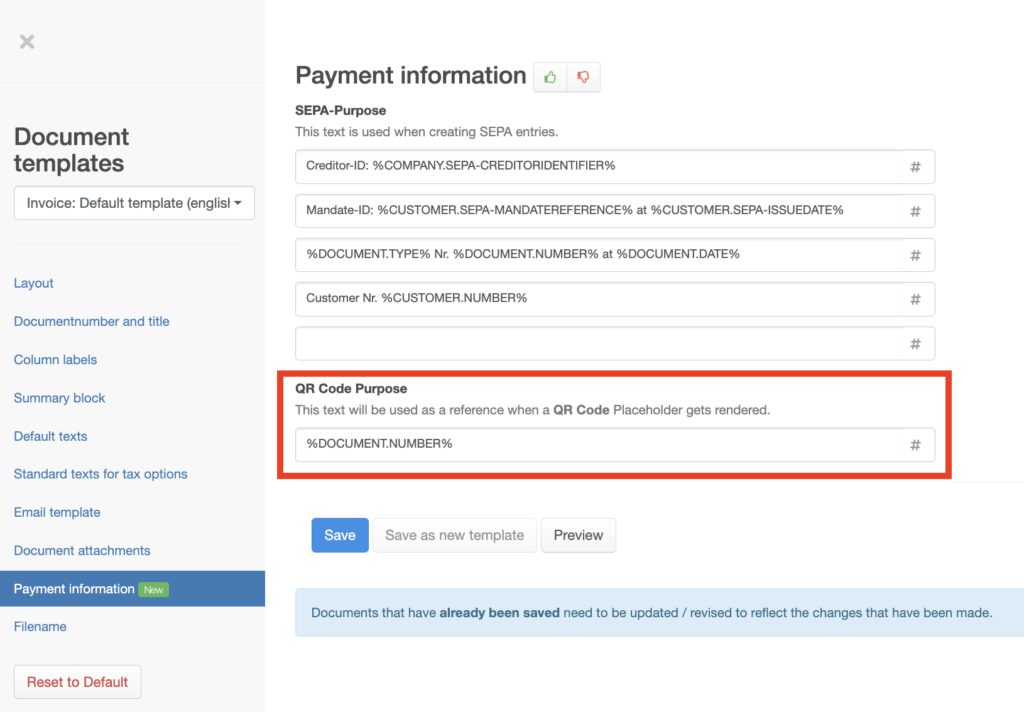

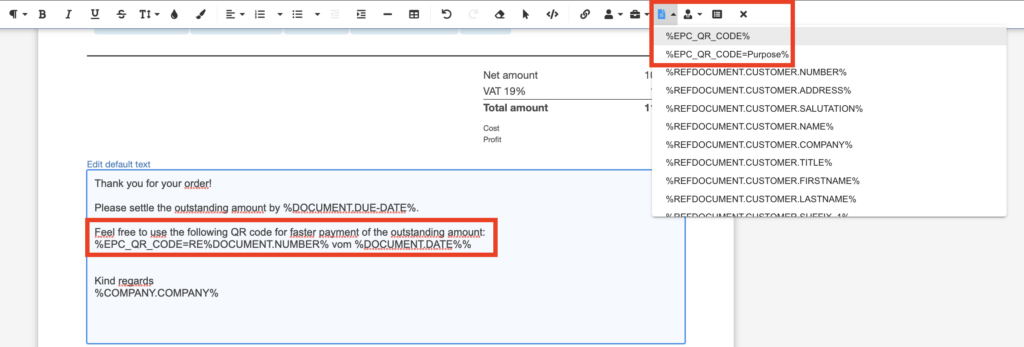

Many entries are therefore purely optional. easybill already takes care of setting the mandatory fields automatically. You can freely define the purpose of use and specify it using placeholders in your account.

Include the EPC QR code in easybill documents

To include the QR code in your documents, there are basically two approaches.

Option 1: You include the new placeholder for the EPC QR code in your document templates or create a new template for bank transfers. In one of the text fields, usually the lower text field, after the total block of the invoice, you insert the placeholder so that easybill can fill the placeholder with the corresponding data of your customer and the invoice contents.

Option 2: You need the QR code only in exceptional cases and don’t want to use it as a default? Then insert the placeholder in the appropriate place directly in the editor when you create your new invoice.

Both variants are explained in detail in our instructions in the Help Center (in german).

Conclusion about GiroCode

To save your customers typing errors and the work involved in creating a transfer manually, it is well worthwhile to use efficient functions such as GiroCode. Your customer can scan the invoice and transfer it directly to you, ensuring faster liquidity for you and your company.

Read also:

The WooCommerce store as a (second) pillar for your business

Do you already know our tax consultant network?