Hard to believe, but true: we have now reached the 10th edition of the “priceless updates”. Have you been following all the content from the very beginning? As an easybill user, we will always keep you up to date on which new features will make your everyday work easier.

You are not yet an easybill user? Then you’ve missed out on a lot of great features so far. It’s about time that this changed.

Let’s take a look at the valuable developments of the last few weeks.

An overview of our recent updates:

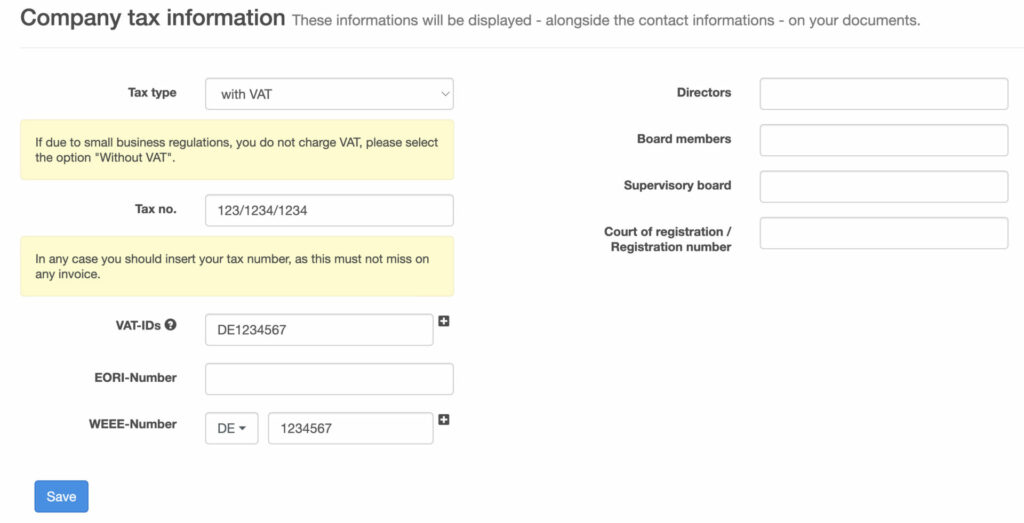

The WEEE number for your documents

The display of the WEEE number for electronic devices, or electrical equipment has now already become mandatory information since 1.07.2023. Since your WEEE number – at least in Germany – must also be shown on the invoice, a separate field has been created in the company information area.

Via your fiscal master data in the main menu you enter the WEEE numbers your company has. Per recognition per shipping destination, easybill displays the associated WEEE number directly under your, if existing, EORI number.

You can read more information about the WEEE number here:

The WEEE number as mandatory information in the marketplace and everything you need to know

Sales stop on Amazon and Co threatens – deposit WEEE number

Extension of search for VAT ID

As a trader you are obliged to check the VAT ID of your customers. If, in the worst case, a VAT ID is invalid, but the invoice was declared tax-free as an intra-community delivery, you must make an invoice correction.

Up to now, you have already been able to find the corresponding customer master via the search in the blue easybill main menu. Now the search has been extended so that you can also display the documents that contain the VAT ID.

Further benefit: Your customer has already received a new VAT ID? Even if you have already updated the customer master in the account, the search will still find the older documents with the previous VAT ID.

Updates around the Import Manager

We also keep our online retailers up to date when it comes to updates to store connections or marketplaces. Without explaining the changes in detail, you can still get an overview here:

- Special tax areas, such as Heligoland or the Canary Islands, are now recognized and processed completely correctly.

- Shopware 6 knows so-called “parent items”, which can recently be output with. If you would like this, please contact our easybill support for the activation of this function.

- ETSY has been added to the list of stores and marketplaces to which shipment data can be reported back. You need a separate right in the ETSY connection for this, so this must be renewed once by your intervention. Afterwards, however, you can import tracking data generated via easybill back to ETSY without any problems.

- Smartstore transmits a store ID, which can now also be output on your documents using placeholders, if you wish.

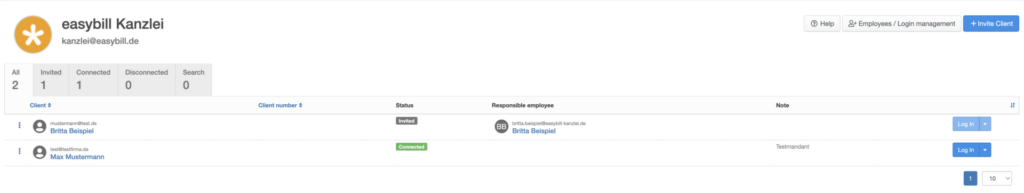

Update in the tax advisor portal

Even tax consultants who use easybill always get their money’s worth with our updates. We take feedback from tax offices, clients and others very seriously and incorporate it into our developments wherever possible. Our development team will find a solution for everyone.

From now on, the responsible employee who works for the client and has been assigned in the tax advisor portal will also be displayed in the overview. We have also included the e-mail address here, so that it is clear at a glance where information is sent to in order to reach this employee.

Perhaps you already manage the client in DATEV under a specific number and would also like to use this in easybill? No problem. Transfer your client numbers manually to the created easybill clients and use them for future exports.

Read also:

Successful invoicing for small business owners: 7 key facts for your business

Effective invoicing: How easybill-CSV Import helps you create invoices

Deposit WEEE numbers in easybill