Are you starting a new Amazon business or have you already been listed as a seller on Amazon for some time? However, due to the often “complicated” perceived wording, you are unsure whether you have set everything correctly for tax purposes? Then we have a particularly good offer for you today: the VAT Setup Check for Amazon.

countX GmbH offers a VAT compliance solution for online merchants that helps you meet your VAT obligations abroad. Many Amazon sellers already use European shipping or even direct storage of goods in other EU countries (PAN EU or CEE program) after a short time. If possible, you should do everything right from the start.

easybill supports the recognition of tax issues when importing your Amazon data. However, much only after activating the appropriate settings. And as a seller, you must of course specify these in your account. But what happens if you are not at all sure which functions you use at Amazon? Have goods been transferred abroad? Have you already been affected by the One-Stop-Shop without being able to track exactly whether 10,000 euros net value of goods have already been moved abroad in the EU? Then we present you the perfect solution today.

VAT Setup Check by countX

One important detail right from the start: the VAT Setup Check is completely free of charge for you. You do not enter into a fixed contract commitment. It has never been so easy to have your Amazon account checked for tax settings. We will gladly explain to you how this works:

Use the VAT Setup Check page to create a free account with countX. Only then can the Amazon interface be connected. You enter your contact details and connect your Amazon account to the countX access, just as you have already done in your easybill account. Another advantage is that you can continue to view the data at any later time.

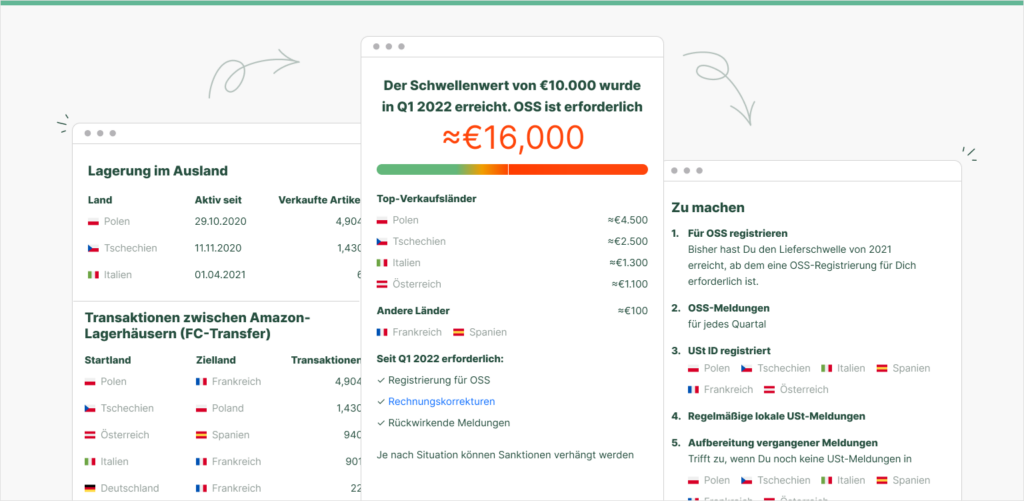

The VAT Setup Check then starts automatically. There are no complicated data or evaluations, so you don’t know what exactly has been checked, because with a graphical representation you can see instantly if you have activated storage abroad, for example. Likewise, the Setup Check checks into which EU countries you have already shipped what value of goods to tell you if you are affected by the OSS. Of course, you can still specify in the Setup Check whether you already have VAT IDs in other EU countries because you have registered locally there.

countX gives you helpful recommendations for action right at your fingertips. Of course, you also have the option of making an appointment for a consultation if the results of the check have surprised you.

Surprising result?

This is unfortunately a conclusion that especially our easybill support receives again and again. Many sellers are not aware of what features they use in Amazon or have unknowingly activated. The effort of correcting invoices is a manageable process in easybill, as we provide you with helpful and reliable solutions with the help of our “batch processing” tool or also the correction path directly via the Import Manager. But what about the tax office? What about past data, your annual financial statements, foreign tax offices, etc.? Do you have the confidence to make a complete correction? Or is it not time to turn to an experienced partner who will accompany you professionally on this path?

countX will take you by the hand and go this way together with you. easybill will support you as usual from the technical side. With two strong partners at your side, you can be sure that the best possible solution will be found for you.