Are you a carpenter, painter or otherwise active in the craftsman sector? Maybe you are just getting started and are still struggling with how a correct and legally compliant invoice should look like. easybill would like to make this step easier for you, so today we will show you how you can make this part of your everyday business as pleasant as possible.

Table of contents

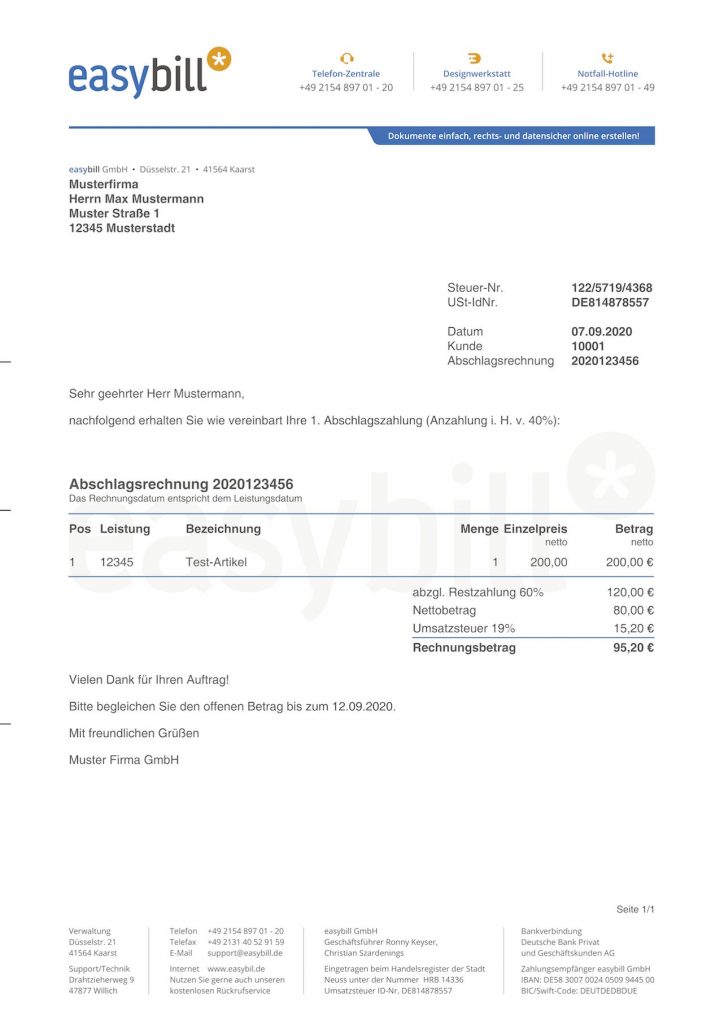

What is a partial invoice?

The partial invoice is a common process that can be found especially in the trade sector, but of course often also in project work, for example at agencies. Almost every day, easybill customer support is asked how a progress bill can be created. We would like to explain what the difference is between this and a “normal” invoice.

A regular invoice is usually issued when the service has been provided or the goods have been delivered. The expense for this is invoiced and paid after the service has been completed. With the partial invoice, on the other hand, it is common to invoice partial amounts, which, as the name suggests, only cover part of the project, but not the whole.

Therefore, the partial invoice can be divided into several steps and only after the completion of the entire service, the final invoice is issued. There are also certain requirements for the final invoice, which we would like to explain once again.

Requirements partial invoice and final invoice

As a craftsman, you naturally have a very precise idea, but also specifications from the tax office, as to what you must include on your invoices. In the case of a partial invoice, the contents are of course similar to the regular invoice. Nevertheless, you should make sure that the following mandatory components are listed:

- Designation of the invoice: The term “partial invoice” must be mentioned on the invoice

- Order number or job number: especially in the trade, you often have to refer to these references so that an assignment is later possible without any problems

- Invoice number: Pay attention to consecutive numbering. Also indicate how many partial invoices the customer has in front of him.

- Your details: Name, company and address

- Details of the invoice recipient: Name, company and address (Billing address)

- Date of the partial invoice

- Delivery period: The period or time at which the service was performed that you are now billing for must also be stated on the invoice. If you perform the service only in the future, the expected delivery date belongs on the invoice

- Description of the goods or service: Describe the service you are billing for as accurately as possible so that there are no discrepancies later on

- Current tax rate

- Your Sales tax identification number (if you report sales tax)

- Reason for exemption from sales tax

- Your hourly rate or unit price: enter your hourly rate if you bill your services on an hourly basis or a unit price if you base the calculation on specific units

- Net and gross amount

In the final invoice, on the other hand, explicitly mention the reference to the final invoice. If desired, you can list all budget billing amounts as separate items. For example, if you enter the total amount as the first item and the deductions already made as items with a negative sign, only the difference would remain as the final invoice. From a tax point of view, this process should be sufficient. However, you should discuss this with your tax advisor before preparing the invoice.

Hourly rate or unit price?

Why is this information relevant for you? In the craftsman sector, it is common practice that certain hourly wages are defined to which the industry is oriented. In order not to impair competition, you should orientate yourself to these specifications in order to create a serious impression with your customers and, of course, also in order to receive the order.

If your customer is concerned that you are far above the usual prices, he will subsequently decide in favor of another craftsman and you will not be awarded the contract. Especially in the start-up phase, it may still be difficult to define an amount. Therefore, it is helpful to measure yourself against the examples of others and wage surveys.

Optimally, you should also discuss with your tax advisor whether a calculation by hours or by units makes more sense in your personal case.

Recurring craft services

As a craftsman, you often have projects that extend over a longer period of time but involve services at regular intervals? You should make payment for these services via progress invoices, so that your company’s liquidity is naturally also ensured. Unforeseen difficulties, delays in delivery, etc. often make life difficult for tradesmen. A progress invoice is more or less like an invoice with reservations, since the final invoice has not yet been issued and the overall project has not yet been completed.

But if you now have recurring activities, take advantage of the recurring invoices in easybill. Create a template once and define all the necessary content. The performance data must be adjusted monthly? No problem. easybill provides you with placeholders with which the date is calculated all by itself.

You define when and how often a finished budget billing is to be generated from the template. If you wish, we can also send it directly to your customer, by e-mail or by post.

easybill as an invoicing tool for the craftsman sector

Precisely because we know about the challenges of your everyday life in the craft sector, you can rely on a strong partner at your side. easybill allows you to manage customer data and also, of course, your items and services. Save yourself the hassle of preparing invoices and receipts when you can have it so easy.

Whether logo or stationery – there are no restrictions to include them directly into your easybill templates. Our focus is your satisfaction and the optimization of your daily work. Your tax advisor will certainly be pleased, too, if he can export the finished document images and accounting proposals for his accounting software directly from easybill.

You can find further information about your industry and additional functions directly on our website: Invoicing solution for the skilled trades.

Read also:

Plan and execute annual financial statements: The Ultimate Guide for Your Business

Efficient collaboration: The easybill tax consultant portal

Successful Business Women: Inspirations and Networks